Over the last 10 years, I have worked with hundreds of organisations to help them improve their approach to corporate risk management. It has been a journey that has seen a real sea change in the importance placed on risk management from a ‘tick in the box’ exercise to a critical and strategic necessity.

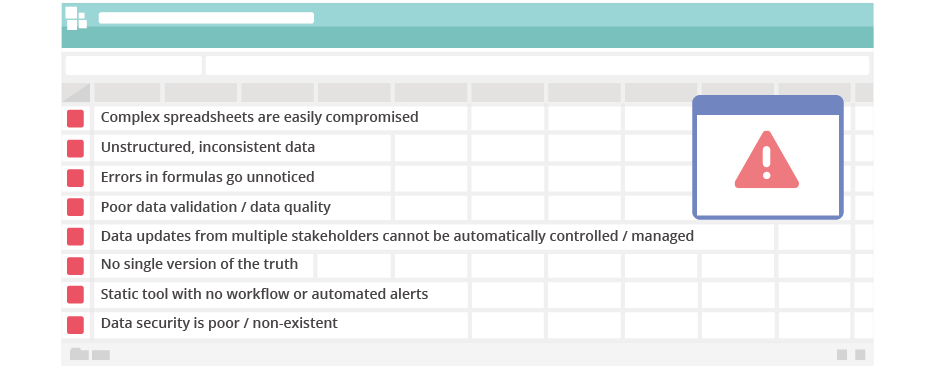

Whilst this positive move from something ‘we need to be seen to be doing’ to something that ‘adds real value’ to the organisation is great – The most worrying thing I see daily is the continued use and reliance on spreadsheets to manage the process.

Risk professionals have arguably never been more important to an organisation; with economic, fraud, regulatory, climate change and cyberspace risks all prominent on their dashboards. And yet, ironically one of the highest risk (and lowest priority to fix) areas the organisation is exposed to is the use of spreadsheets in the risk process itself.

It, therefore, makes sense that regulators are focusing on the use of spreadsheets as a key concern to delivering best-practice corporate governance.

Stuck in spreadsheet purgatory

What is the risk?

Leadership teams of public & private sector bodies have a plethora of fiduciary, statutory, reporting and compliance obligations. Failing to meet these obligations can lead to fines, jail sentences and negative impacts on shareholder value. Trying to meet these obligations when the very information upon which decisions are made is unreliable, is incredibly risky.

The ugly result of businesses that have relied upon and fallen foul of uncontrolled, untested and inaccurate spreadsheets is unsettling and all too common.

Mouchel Pension Fund Disaster

Outsourcing specialists Mouchel had a £4.3m profits write down due to a spreadsheet error in a pension fund deficit caused by an outside firm of actuaries. Not only did Mouchel’s profits take a huge hit but it also caused their share price to drop and their chairman to resign amid fears they would break their banking agreements.

Implementing a bespoke Risk Management solution will provide the peace of mind and tools to ensure confident decision making within your organisation.

Ideagen provides software designed to give businesses a holistic view of risk, removing the potential for spreadsheet mishaps and adding real business value through accelerated risk calculations, better communication and enhanced reporting.

With Pentana Risk, our cloud-based performance and risk management software, we have been recognised as a CHALLENGER in Gartner's Magic Quadrant for Integrated Risk Management report.